Any business aiming to control and optimize their expenses can benefit from implementing structured and consistent Cost Management. It's a journey toward not just surviving but thriving in an ever-evolving marketplace.

In this article, we'll break down what this practice entails, highlight its key benefits, and introduce you to effective tools that can help you manage your costs efficiently.

Whether you're navigating the financial landscape of a startup or managing costs in a large organization, understanding these principles can make a significant difference.

Curious to learn more about optimizing your financial strategies?

Keep reading!

Table of contents

- What is Cost Management?

- Why is controlling costs important?

- 4 steps to build a Cost Management plan.

- Project Cost Management tools.

What is Cost Management?

Cost Management refers to the process of planning and controlling the budget of a business or project. It involves a series of activities for predicting, monitoring, and managing costs effectively to prevent budget overruns.

It encompasses a broad range of activities that look to ensure that expenses do not exceed allocated resources. Some of those activities include:

- Forecast costs accurately.

- Allocate budgets efficiently.

- Monitor expenditures continuously.

- Implement measures to control costs.

Cost Management is a very healthy practice that can (and should) be implemented no matter the size of your organization. The scope ranges from managing a small project's budget to handling the complex finances of a multinational corporation.

Why is controlling costs important?

Controlling costs is important for maintaining the financial health and sustainability of any business. It ensures that resources are used efficiently, reduces the risk of budget overruns, and maximizes profitability.

A robust Cost Management process, supported by FP&A software, enables businesses to plan for future growth, handle unforeseen expenses, and make informed strategic decisions.

For many reasons, the negative consequences of not performing Cost Management are also plenty:

- Without cost control, projects could easily exceed their budgets, leading to financial strain and potentially putting the project or business at risk.

- Poor cost accounting can result in insufficient funds to cover operational expenses, leading to cash flow problems that disrupt business operations.

- Poorly allocated resources can stop a business from taking advantage of new growth or innovation opportunities.

- Unchecked spending can eat into profit margins, leaving the business with less money to reinvest or share with shareholders.

- Consistently failing to manage costs effectively can harm a company’s reputation with investors, clients, and employees, undermining trust and confidence in the business.

Now, imagine this scenario: a construction company that does not have a Cost Management plan in place. As the project progresses, they encounter unforeseen expenses such as higher material costs and additional labor due to delays. These unexpected costs accumulate, causing the project to go significantly over budget.

Unable to cover these expenses, the company faces cash flow problems, delaying payments to subcontractors and suppliers. This not only strains relationships with key partners but also puts the company's reputation and future projects at risk.

This scenario illustrates why effective Cost Management is important. But let’s explore more of its benefits and challenges.

Cost control benefits

Here are the main benefits of implementing Cost Management:

- Maintaining control over costs helps businesses keep their financial standing strong, ensuring they have the funds necessary for operations, growth, and emergencies.

- Minimizing unnecessary expenditures, means you can have better profit margins and reinvest savings into growth initiatives or new opportunities.

- Effective cost control allows for the optimal allocation of resources, ensuring that funds are directed toward high-priority projects and essential operational needs.

- Accurate and timely cost data helps management make better strategic decisions, from pricing strategies to market expansion.

- Keeping costs in check helps anticipate and manage financial risks, reducing the likelihood of crises arising from budget mismanagement.

Let’s explore briefly what a good Cost Management plan would look like for a mid-sized software development company.

They could be minimizing unnecessary expenditures on office supplies and assets, travel, and non-essential equipment, in the hope of increasing their profit margins by 12% year-over-year. These savings would be reinvested into expanding their product line and entering new markets.

Their finance team will closely monitor project costs, ensuring resources are allocated optimally to high-priority initiatives. Accurate cost data informs strategic pricing decisions, allowing them to stay competitive while maintaining healthy margins.

This proactive approach prevents budget crises and maintains this tech company’s reputation for reliable delivery, securing ongoing business from key clients and contributing to their sustained growth and profitability.

Cost control challenges

Now, it’s important that organizations also consider that defining and implementing a Cost Management plan can present difficulties. These are the main ones:

- Predicting costs accurately can be difficult, especially in dynamic markets or during times of economic uncertainty. Inaccurate estimates means budget shortfalls.

- Adhering to various regulatory requirements can complicate Cost Management, as compliance often involves additional expenses that need to be controlled without compromising legal standing.

- Implementing cost control measures often requires changes in processes or behaviors within an organization, which can meet resistance from employees or stakeholders.

- Relying on outdated or inaccurate data can mislead cost control efforts, resulting in poor financial decisions.

- Cutting costs without sacrificing product or service quality can be a challenging balance to achieve, especially in competitive markets.

To put this into perspective, imagine a manufacturing company facing some of the cost control challenges we mentioned above. For instance, fluctuating raw material prices make accurate cost predictions difficult, leading to budget shortfalls. Regulatory compliance adds expenses, also complicating the initial plan.

On top of this, implementing cost-saving measures can meet resistance from employees and stakeholders, slowing down the progress. Or it can be difficult to cut costs without compromising product quality proves challenging in a competitive market.

Now, let’s get to the gist of it.

4 steps to build a Cost Management plan

1. Identify costs

Start by identifying all potential costs associated with the project or operation. Create a comprehensive list including both direct and indirect costs.

For example, in IT Cost Management, direct costs might include hardware purchases and software licenses, while indirect costs could encompass electricity, cooling for data centers, and staff salaries.

2. Estimate costs

Once costs are identified, estimate them as accurately as possible. Use historical data, quotes from vendors, and expert input to create realistic cost estimates.

In IT, this could involve estimating the cost of upgrading servers, renewing software subscriptions, or hiring additional IT support staff.

3. Develop a budget

Compile the estimated costs into a detailed budget. Allocate funds to different categories and ensure that the total stays within the project's financial constraints.

For an IT project, IT budgeting might allocate specific amounts to hardware, software, personnel, and maintenance, ensuring there are no overruns.

4. Monitor and control costs

Implement mechanisms to continuously monitor and control costs throughout the project. Regularly compare actual expenditures to the budget, identify variances, and take corrective actions as needed.

In IT, this could involve using Cost Management software to track ongoing expenses, conducting regular financial reviews, and adjusting spending plans based on real-time data to avoid budget overruns.

Project Cost Management tools

The best way to go about it is if you use a combination of different tools to allow for a comprehensive approach to Project Cost Management. Of course, you can also choose to prioritize one or another depending on your specific goals.

In short, they help project managers estimate costs accurately, create detailed budgets, monitor spending in real-time, and make data-driven financial decisions to ensure project success.

Project Management software

Tools like Microsoft Project, Asana, and Trello allow for comprehensive planning and tracking of project tasks and associated costs. Oriented to Project Management more in general, they can also be tailored to cost control practices, helping project managers assign resources, set budgets, and monitor expenses in real-time.

IT Asset Management (ITAM) tools

For IT cost control, ITAM tools can be a great ally. These tools help manage the lifecycle of IT assets, from procurement to retirement, providing detailed insights into costs, depreciation, and maintenance.

They ensure that IT expenditures are tracked and allocated efficiently, helping to avoid unnecessary expenses and optimize IT resource utilization.

Cost estimation tools

Software such as CostX, RSMeans Data, and CoConstruct provide features for detailed cost estimation. These tools use historical data, industry benchmarks, and real-time quotes to generate accurate cost projections for various project components.

Budgeting tools

Budgeting tools like PlanGuru, QuickBooks, and FreshBooks help to compile detailed budgets, allocate funds to different categories, and track expenditures against the budget. They often include forecasting and financial reporting features to help maintain financial control.

Cost monitoring tools

Tools such as SAP, Oracle Financials, business credit cards and Procore provide robust cost monitoring capabilities. These tools (also known as procure-to-pay systems) enable real-time tracking of expenses, identify variances between budgeted and actual costs, and offer dashboards and reports for financial analysis.

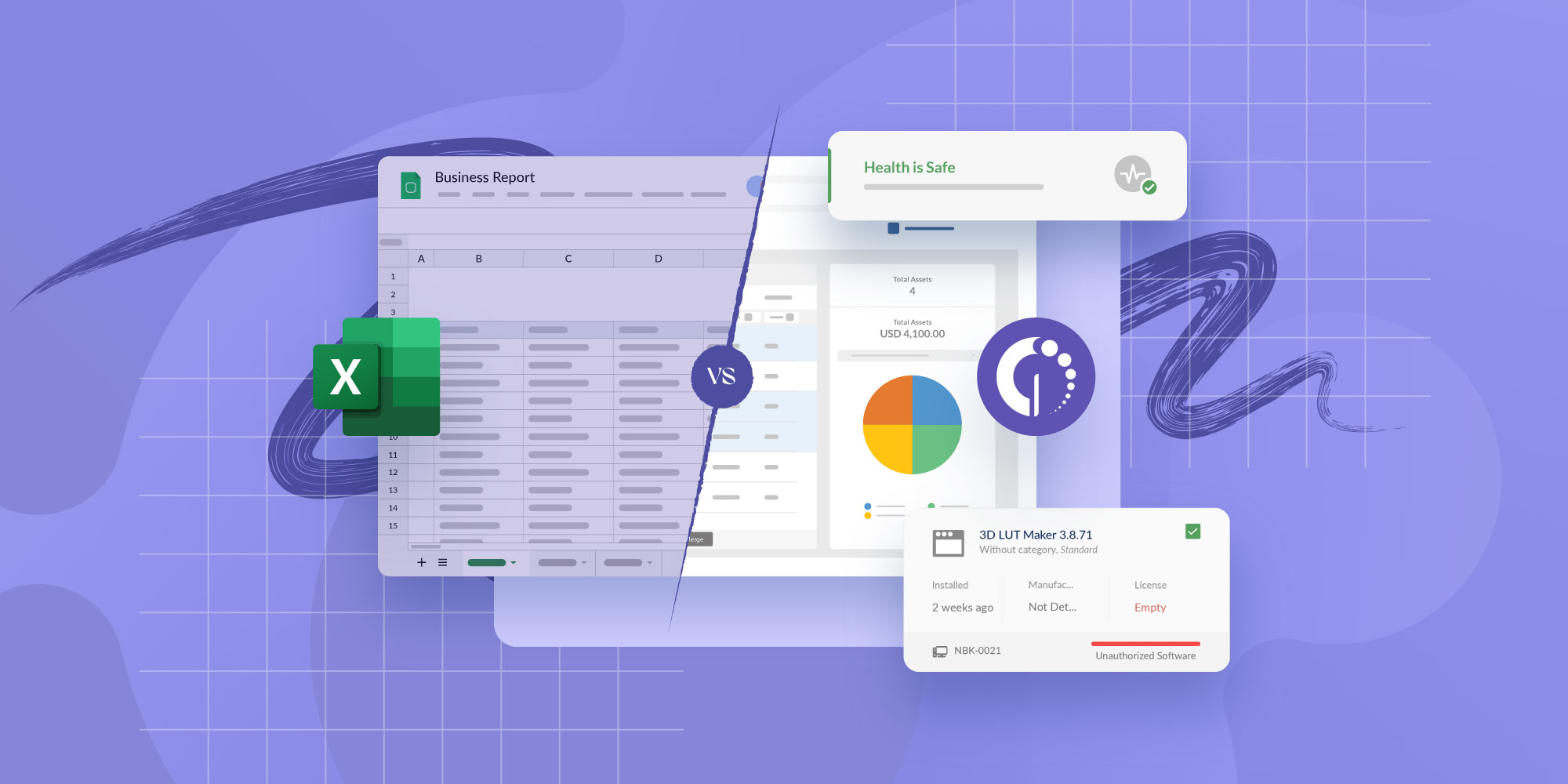

Spreadsheets

Despite the availability of specialized software, many organizations still use spreadsheets like Microsoft Excel and Google Sheets for Cost Management. While less sophisticated and can fall short in functions, spreadsheets can be suitable for smaller projects or supplementary tracking.

The bottom line

Putting effort into Cost Management is crucial for any business or project. It ensures financial stability, enhances profitability, and facilitates informed decision-making.

Overall, it is a healthy practice that makes sure that financial resources are not just monitored but optimized for maximum impact, guarding against budget overruns and fostering unparalleled project success.

To be effective, it comes with its own set of challenges that need to be managed. For this, controlling costs requires a variety of tools to plan, estimate, budget, and monitor project expenses. And, InvGate Asset Management can be a great ally for this. Don't believe us? Ask for your 30-day free trial and see for yourself.