Have you ever wondered how businesses manage the value of their technology over time? Understanding the depreciation of IT assets is key to managing them. It helps to keep your organization's financials accurate and resources well-distributed. Depreciation helps you spread the cost of IT assets over their useful life so you can plan and manage them effectively.

In this article, we will explore what depreciation of IT assets means and how it fits in the bigger picture of an IT Asset Management (ITAM) strategy. We'll also cover calculation methods, how to choose the right one for each asset, and the importance of tracking these changes.

So, get ready to dive deep into the world of IT asset depreciation!

Depreciation of IT assets: What is it?

Depreciation refers to the accounting method used to allocate the cost of a tangible asset over its useful life. Essentially, it helps businesses spread out the expense of an asset instead of charging the full cost in the year it was purchased. This practice is vital for accurately reflecting the financial status of a company.

An asset, in this context, is any resource owned by a business that is expected to provide future economic benefits. Examples of IT assets include computers, software, servers, and networking equipment. The depreciation of IT assets specifically focuses on how these resources lose value over time due to factors like wear and tear, technological obsolescence, and market demand.

Why is depreciation important in IT Asset Management?

Understanding the depreciation of IT assets is crucial for effective Financial Management. IT assets can be costly, and failing to account for their depreciation accurately can lead to issues in financial planning and asset lifecycle management. Depreciating IT assets helps organizations in the following ways:

- Accurate financial reporting: Knowing the current value of your assets allows you to maintain clear financial records.

- Tax benefits: In many regions, depreciation can be deducted as an expense, helping reduce taxable income.

- Informed decision-making: Depreciation data helps in deciding when to replace or upgrade IT assets. It helps optimize lifecycle management and plan for future investments.

For example, a server purchased for $20,000 won’t retain the same value over five years. Tracking depreciation will allow you to record its decline in value, helping you plan when to replace it or what residual value you can still gain if it’s sold.

Asset types: understanding what we mean by IT assets

When we talk about IT Asset Management (ITAM) and depreciation, it's important to first clarify what we mean by "assets." Simply put, an asset is anything a company owns that has value. However, not all assets are the same, and not all fall under the scope of ITAM. Let’s break down the types of assets and understand which ones are relevant to managing IT infrastructure

Fixed assets

Fixed assets are long-term, tangible items that are used in business operations. In the context of IT, these are typically physical pieces of hardware that form the backbone of an organization's technology infrastructure. Examples include:

- Servers: Central to operations in many IT environments, servers are used for hosting applications, storing data, or managing networks.

- Desktop computers and laptops: Essential for employee productivity, these devices are typically replaced every few years due to technological advancements and performance limitations.

- Networking equipment: This category includes routers, switches, firewalls, and other components that keep an organization's data flowing smoothly.

- Data center infrastructure: Assets such as power supplies, cooling systems, and racks that support IT operations in large-scale environments.

Fixed assets are the main focus of depreciation in ITAM because they experience wear and tear over time, eventually needing replacement or upgrades. Properly accounting for this depreciation is crucial for budgeting and financial reporting.

Current assets

While current assets aren’t always part of the ITAM conversation, they can occasionally apply in certain IT contexts. Current assets are typically short-term resources that a business expects to convert to cash or use up within a year. In IT, this might include:

- Consumable IT supplies: Items like printer cartridges, cables, or other low-cost accessories.

- Short-term IT investments: Some companies may invest in temporary technology solutions, such as short-term software licenses or leased hardware.

- Cash allocated for IT projects: Budgets set aside for immediate IT purchases or repairs, though not physical assets, are part of a company's overall asset management plan.

Current assets don’t depreciate in the same way fixed assets do, as they are generally used up or sold within a short period. However, tracking them helps ensure that budgets align with immediate IT needs.

Intangible assets

Intangible assets, though not physical, provide significant value to an organization. In IT, these are becoming increasingly important and include:

- Software licenses and subscriptions: Whether for operating systems, productivity software, or security tools, software is a major part of IT operations. Unlike hardware, software is typically amortized over its useful life instead of depreciated, meaning its value is expensed over time but in a slightly different way.

- Patents and proprietary technology: Some organizations may hold patents on their IT innovations, such as unique software solutions or processes. These are valuable assets that contribute to the company’s competitive edge.

- Intellectual property: This might include proprietary algorithms, data sets, or other innovations that contribute to the organization's IT strategy.

Though intangible assets don’t wear out like hardware, they still require careful management. For example, software licenses often need to be renewed or upgraded, and intellectual property must be protected.

Important concepts for IT asset depreciation

Understanding depreciation is essential for managing IT assets effectively. It involves more than just accounting for the passage of time; several factors influence how assets lose value over their lifecycle.

Let's break down some of the most important concepts to keep in mind when dealing with asset depreciation.

Asset's useful life

The useful life of an IT asset is the expected period during which it will continue to deliver value to the business. This timeframe can vary significantly depending on the type of asset, its purpose, and external factors such as industry changes. For example:

- Technological evolution: IT hardware and software are prone to becoming outdated rapidly. A server purchased today may be replaced within five years due to better alternatives.

- Intensity of usage: Assets that are heavily used will naturally have shorter useful lives. Servers running critical systems may depreciate faster than devices used occasionally.

- Maintenance practices: Assets that are well-maintained often retain their value longer. Regular updates and repairs extend useful life, while neglect can result in earlier failure.

Tracking the useful life of each asset helps in planning for replacements, upgrades, or reassigning its function to less critical roles within the company.

Salvage value

This is the estimated resale or scrap value of an asset after its useful life ends. It represents the portion of the initial cost that cannot be depreciated. Accurately estimating salvage value is important for calculating depreciation because it determines the total amount that will be written off over time.

For example, if a laptop is purchased for $1,200 and is expected to have a resale value of $200 after four years, its depreciable cost would be $1,000. This value is spread across the four years to calculate annual depreciation. Underestimating or overestimating the salvage value can lead to inaccurate financial records.

Lifespan vs. useful life

While they are often used interchangeably, lifespan and useful life represent different concepts. Lifespan refers to the total time an asset remains functional, regardless of whether it still holds economic value. Useful life, on the other hand, is the period during which the asset contributes to the company's revenue or productivity.

For example, a company may continue to use a five-year-old desktop computer even though its useful life has technically ended. The computer may still be functional, but it no longer meets the performance requirements of modern business applications, leading to a need for replacement.

What is a depreciation schedule?

A depreciation schedule is a detailed plan that outlines how an asset's value decreases over time. It typically includes the asset's purchase date, cost, useful life, salvage value, and the method of depreciation used.

This schedule helps businesses track their assets' depreciation for accounting and tax purposes. With an accurate depreciation schedule, companies can ensure they correctly report their financial status and make informed decisions about Asset Management.

How do you calculate asset depreciation? Types of depreciation

There are several methods for calculating the depreciation of IT assets, each with its advantages and disadvantages. The most common types include:

Straight-line depreciation

The straight-line method spreads the cost of an asset evenly over its useful life, meaning the same amount of depreciation is charged each year. This method is widely used because it is simple and provides a steady expense over time, making it easy to predict and budget for asset depreciation.

Formula:

Depreciation expense = (Useful Life of Asset ⁄ Cost of Asset) − Salvage Value

- Cost of asset: The purchase price or initial value of the asset.

- Salvage value: The asset's estimated residual value at the end of its useful life.

- Useful life: The period during which the asset is expected to be productive.

Example: Suppose you buy a server for $10,000, and it has a useful life of 5 years with a salvage value of $1,000. The annual depreciation expense would be:

(10,000 − 1,000) ⁄ 5 = 1800

So, each year, you will record $1,800 in depreciation.

2. Declining balance depreciation

This accelerated depreciation method allows you to write off larger amounts of the asset's cost in the earlier years of its useful life. It reflects the fact that many IT assets (like computers and networking equipment) lose value quickly after purchase. The most common variant of this method is the double declining balance (DDB) method.

Formula:

Depreciation expense = 2 × Straight-line depreciation rate × book value at beginning of year

Example: If the server costs $10,000, has a useful life of 5 years, and no salvage value, you calculate the straight-line depreciation rate first:

Straight-line rate = 1⁄5 = 0.20

Now, double that rate (0.40 or 40%) for the DDB method. In the first year, the depreciation expense would be:

10,000 × 0.40 = 4,000

In the second year, you apply the 40% to the remaining value:

(10,000 − 4,000) × 0.40 = 2,400

The expenses get smaller each year, reflecting the rapid initial loss of value.

3. Units of production depreciation

This method bases depreciation on how much the asset is used rather than on time. It’s ideal for assets like printers, vehicles, or machinery that wear down based on usage. To calculate this, you need to estimate the total number of units the asset can produce or its expected output over its lifetime.

Formula:

Depreciation expense per unit = (Cost of asset − Salvage value) ⁄ Total estimated units produced

Depreciation expense = Depreciation expense per unit × Units produced in period

Example: If you have a $10,000 server expected to handle 50,000 work cycles over its life and has no salvage value, the depreciation per cycle is:

(10,000 − 0) ⁄ 50,000 = 0.20

If it processes 12,000 cycles in the first year, the depreciation expense is:

0.20 × 12,000 = 2,400

This method adjusts based on actual usage, making it more flexible for fluctuating workloads.

4. Sum-of-years-digits depreciation

This is another accelerated depreciation method where more depreciation is recorded in the early years of an asset's life. The sum-of-years-digits (SYD) method uses a fractional approach to calculate depreciation.

Formula:

Depreciation expense = Remaining useful life ⁄ Sum of years × (Cost of asset − Salvage value)

- Sum of years: The sum of the digits of the asset's useful life.

For an asset with a 5-year life, the sum is 1 + 2 + 3 + 4 + 5 = 15.

Example: If the server costs $10,000 with a 5-year life and no salvage value, the sum of the years is 15. In the first year, you calculate depreciation like this:

Depreciation for year 1 = 5 ⁄ 15 × (10,000 − 0) = 3,333

In the second year:

Depreciation for Year 2 = 4 ⁄ 15 × 10,000 = 2,667

This method assigns more depreciation in the earlier years when the asset is more productive.

Choosing the right depreciation method

Selecting the best depreciation method depends on the type of asset and how it is used within your IT infrastructure. Here are some tips for choosing the right method:

- Understand the asset’s usage: If your asset loses value quickly or sees heavy use early on (like servers), an accelerated depreciation method is likely the best option.

- Financial reporting needs: If consistent and predictable expense reporting is important, straight-line depreciation may be a better choice.

- Monitor wear and tear: For assets with variable usage, such as network devices or data centers, units of production can offer a more accurate reflection of depreciation.

- Industry regulations: Be aware of industry-specific tax rules or accounting standards that might influence your choice.

Accumulated depreciation

The point of using these depreciation methods is to calculate the accumulated depreciation, which is the total depreciation an asset has incurred over its useful life. This value is essential for determining the book value of the asset, which is its original purchase cost minus the accumulated depreciation.

Knowing the book value helps businesses understand how much an asset is worth on their financial statements, aiding in budgeting, asset replacement planning, and tax reporting.

How can InvGate Asset Management help?

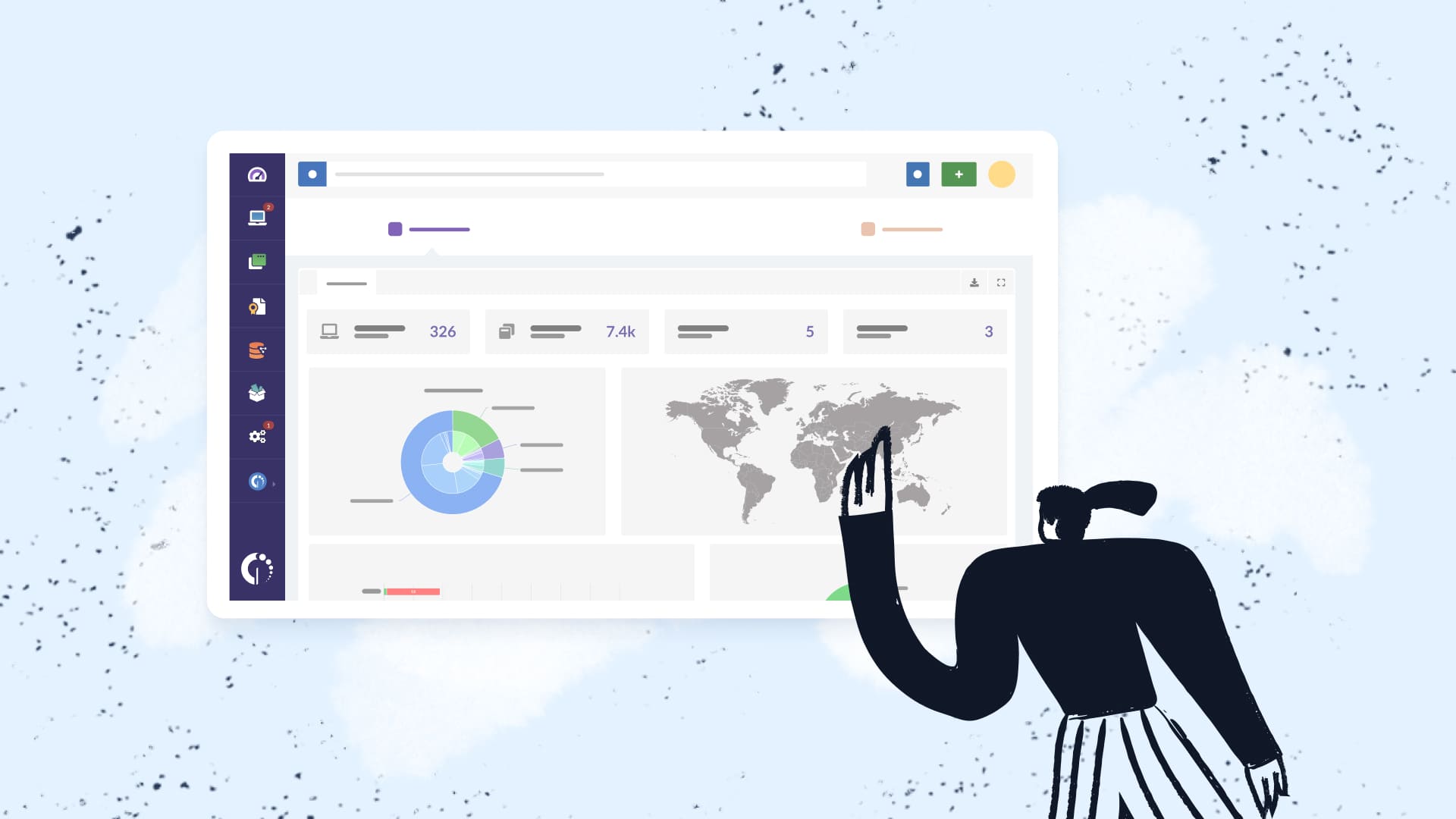

InvGate Asset Management is a powerful ITAM solution designed to help businesses manage their IT assets effectively. It provides comprehensive visibility into asset performance, enabling organizations to make data-driven decisions about their technology investments.

InvGate Asset Management allows businesses to stay on top of their depreciation of IT assets, ensuring they maximize their return on investment.

With InvGate's automatic depreciation functionality, you can:

- Create customized depreciation rules tailored to specific asset types and manufacturers

- Choose between different depreciation methods.

- Set precise depreciation periods and define the useful life of your assets

- Automatically calculate and update asset values.

Factors influencing IT asset depreciation

IT asset depreciation is a unique case compared to other types of assets. The factors influencing IT asset depreciation are quite specific and complex.

Let's explore how these elements come into play:

Technological advancements

Rapid changes in technology often mean that IT equipment becomes obsolete before it physically deteriorates. Companies should factor this into their depreciation schedules to reflect the fast pace of innovation.

For example, the lifespan of software can greatly affect hardware depreciation. As software requirements increase, older hardware may no longer be able to run the latest versions effectively.

Here's another case: the value of IT equipment often drops sharply once the manufacturer ends support for that model. This is particularly true for networking equipment, servers, and specialized hardware where ongoing security updates and technical support are crucial.

What does this mean? For instance, a top-of-the-line laptop purchased today may be outdated within two to three years despite being fully functional. Since IT assets depreciate much faster than traditional assets, many organizations use accelerated depreciation methods for their IT equipment.

Maintenance and upgrades

Regular maintenance can extend the life of IT assets, delaying the need for depreciation. This can include cleaning, software updates, and component checks.

Upgrades also play a role. Some IT assets, especially in enterprise environments, are designed with modularity in mind. Upgrading specific modules (like network cards in a server) can be more cost-effective than replacing the entire system.

But remember that the cost of maintenance and upgrades should always be weighed against the extended lifespan and improved performance. In some cases, the cost of maintenance or upgrades might exceed the benefit of keeping older equipment operational.

Usage and workload

Heavy use accelerates depreciation. If an IT asset is running 24/7 or handling resource-intensive tasks, it will lose value faster than equipment that is used sporadically. IT equipment in high-usage scenarios often requires more robust cooling solutions. The depreciation of these cooling systems should also be considered alongside the IT assets themselves.

Businesses should regularly evaluate how their assets are being used to determine whether their depreciation calculations remain accurate.

Resale and disposal value

As mentioned earlier, salvage value is a key element in calculating depreciation. However, market conditions in IT follow a particular logic.

Moore's Law, articulated by Gordon Moore in 1965, posits that the number of transistors on a microchip doubles approximately every two years, leading to exponential increases in computing power while simultaneously reducing costs.

What does this mean for depreciation? That IT equipment often experiences a steep decline in resale value. A server or high-end workstation that was top-of-the-line two years ago might be outperformed by much cheaper models today, significantly reducing its resale value.

In certain cases, resale value may plummet if the market is flooded with similar technology, while some high-demand items may retain their value longer than anticipated.

To sum up

IT assets present unique challenges when it comes to calculating depreciation. Hardware, software, and other IT-related resources have different lifespans, and factors like rapid technological advancements, usage patterns, and maintenance needs must all be considered. Understanding these particularities is essential for keeping IT budgets accurate and making informed decisions about replacements or upgrades.

Having a strong IT Asset Management (ITAM) system in place is crucial for staying on top of this. It not only helps track the depreciation of your IT infrastructure but also ensures you're managing your assets efficiently over their entire lifecycle. With the right strategy, businesses can optimize their resources and avoid unexpected costs.

A tool like InvGate Asset Management can help you streamline your ITAM processes by automating asset tracking, providing real-time insights, and simplifying depreciation management. Ask for a 30-day free trial and get on top of your IT Asset Management