Total Cost of Ownership (TCO) often comes up when talking about IT management, but not everybody knows its full utility. Most of the time, the cost of an IT asset is only associated with its purchase or licensing fee. However, that’s not the only expense you should consider.

There are several associated costs that affect the TCO – such as maintenance, support, and guarantee. So, it is particularly useful as it gives you a clear picture of how much you are investing in your assets.

Since there are many variables on the table, this IT Asset Management (ITAM) metric can be often hard to calculate – especially if you don’t have the right tools to feed you updated information,

Keep reading to explore how to calculate TCO, and how InvGate Asset Management will become your best ally to do it easily and properly.

What is the Total Cost of Ownership?

Before you start calculating the TCO of your assets, you must consider all the elements to include and understand how tracking it can help you in your daily work. The Total Cost of Ownership essentially measures the total costs associated with an asset.

These costs are established in the IT assets' lifecycle, and include:

- Purchasing prices.

- Setup and installation.

- Training.

- Legal and licensing fees.

- Hosting.

- System support.

- Hardware and software maintenance.

Summing up these figures, organizations can better understand how much they are spending on each asset and the entire cost of acquiring new ones. In addition, it helps businesses compare different possibilities and ensure they are getting the right solution for their needs at a cost-effective total value.

Pros and cons of TCO

Calculating the TCO can be highly beneficial for your organization to efficiently plan its ITAM strategy. However, there are also certain difficulties to consider when tracking it. Among the advantages, we can find:

- Visibility - It helps you identify the precise total cost of an asset.

- Better decision-making - You can compare different solutions and identify which one is more cost-effective in the long run.

- Budget planning - It helps you allocate resources more efficiently for IT assets before purchase.

Nevertheless, you should also consider that sometimes it can be hard to incorporate all of the costs involved, as some of them are difficult to:

- Predict - Even with an estimation, you can't always know exactly how much a product's maintenance will cost.

- Understand - It's tricky to identify some costs that are not directly related to the asset and are subject to external variations (such as training or legal fees).

The Total Cost of Ownership formula

Now, let's see how to calculate the TCO of your assets. To start the process, businesses must spot and incorporate all the costs associated with the IT assets they are tracking. Once these costs have been correctly identified, the formula is as follows:

TCO = Initial cost (I) + Maintenance cost (M) + Remaining cost (R)

Components of Total Cost of Ownership

Let's look into the three main elements of the formula in more detail:

- Initial cost (I) - The initial purchase price of an IT asset. This could be anything from purchasing new hardware or software, setup and installation fees, or any additional costs associated with getting started.

- Maintenance cost (M) - Ongoing charges, such as licensing fees, subscriptions, and other service-related costs.

- Remaining cost (R) - Additional costs associated with the asset, including hosting fees, training and education, system support, and legal or compliance-related expenses.

How to leverage the Total Cost of Ownership in IT with InvGate Asset Management

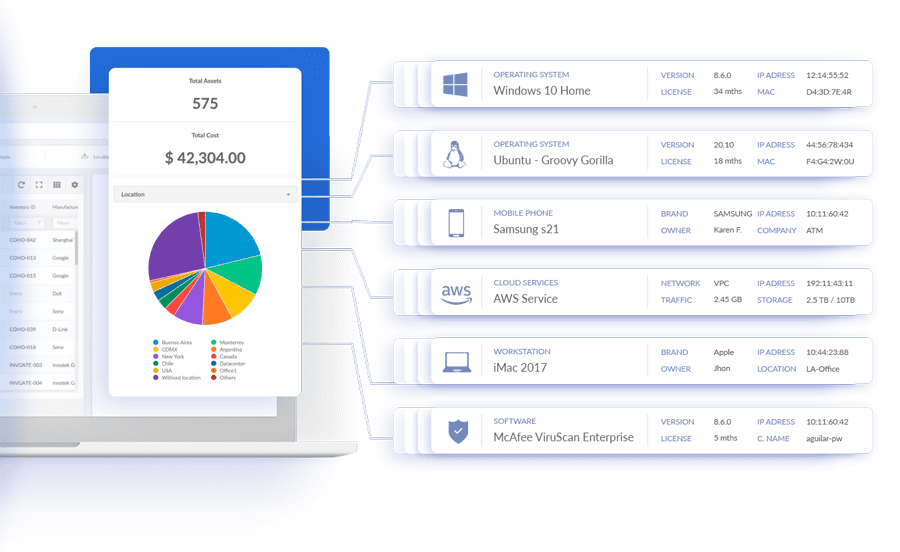

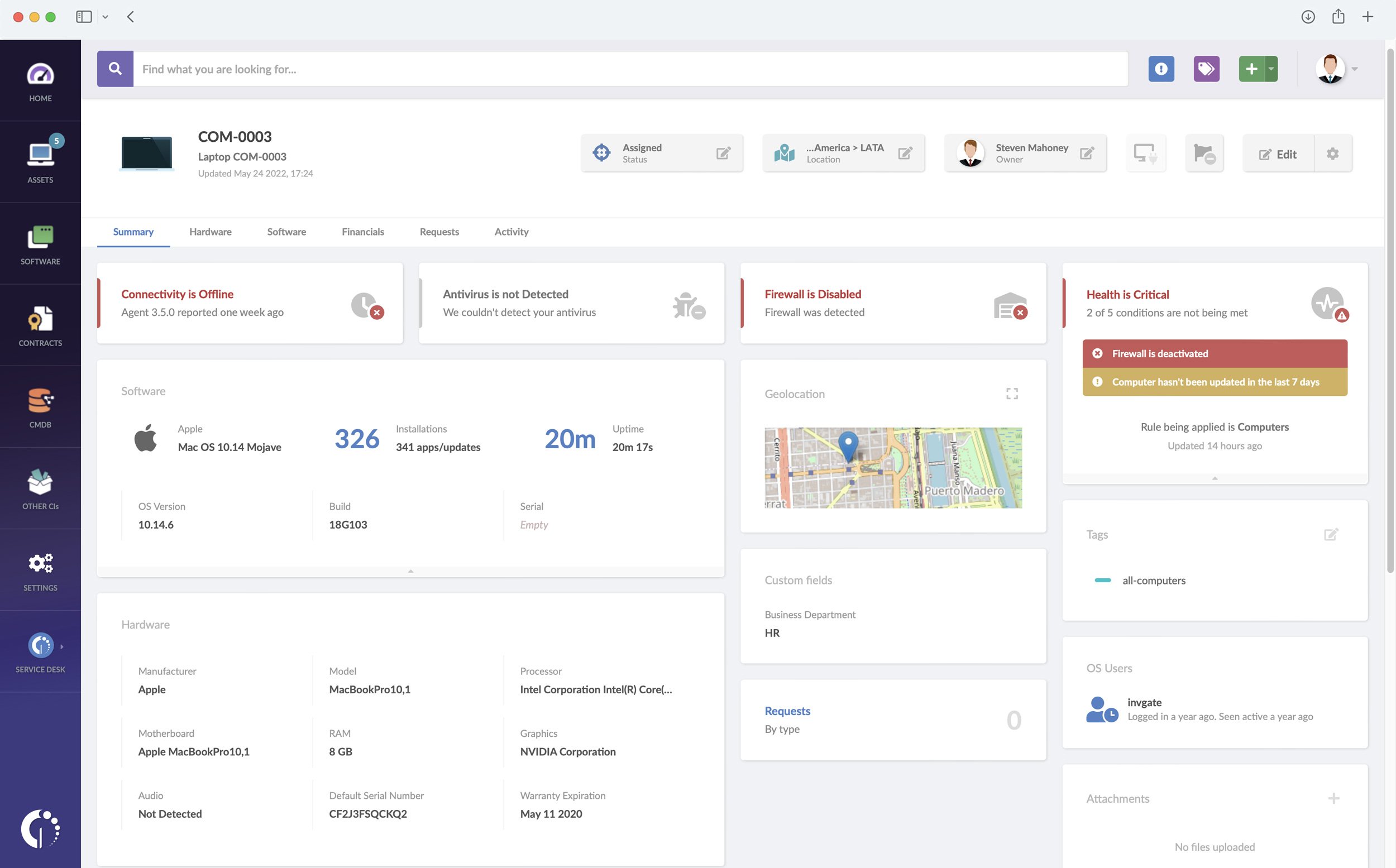

The main advantage offered by InvGate Asset Management when calculating your TCO is that it provides you with organized and complete visibility of your IT assets' costs.

Our ITAM software lets you create a unified inventory of your assets – including hardware, software, users, locations, contracts, and custom CIs. You can also log information on every independent asset's cost and easily access the data through its profile. Plus, you can create reports and get a quick view of the costs of a group of assets by using the search bar, filters, and conditionals.

So, let's say you want to go over a piece of software. Just by opening its profile, you’ll get visibility on:

- Licensing.

- Support and maintenance.

- Associated contracts.

- Other related assets like feature flags, users with a license, and devices where it's installed.

Thus, with one click, you can see updated information on most of the variables needed to calculate the TCO of that software.

InvGate Asset Management also includes automation features to increase TCO accuracy. For example, you can track the depreciation of that an asset, to see the amount of value it will lose over time. This is especially useful for computers, tablets, and smartphones. Or you can automate the contract expiration date to receive notifications and be on top of the Contract Lifecycle Management.

4 TCO examples to put into practice

Now that you know how to calculate the TCO and the benefits of using InvGate Asset Management to do so, you can either have many ideas to implement it or be slightly confused about where it's best to start. Whichever the case, let's take a look at some examples of how to put this metric into practice:

- Total Cost of Ownership cloud vs. on-premise - When considering an enterprise IT solution, calculating TCO can help you decide between cloud and on-premise solutions. In general, the initial implementation cost for a cloud-based solution is lower, but ongoing costs such as maintenance and administration may be higher.

- Total Cost of Ownership for hardware - Calculate the TCO of your company’s hardware to understand how much its spending and whether it’s viable to acquire more. When doing so, remember to include the cost of the initial purchase price along with any ongoing expenses related to that specific asset.

- Total Cost of Ownership for software - The same as with hardware, calculating your organization's TCO can help you manage your budget efficiently. Just don't forget to include in the calculations any additional licenses or upgrades that might be required over the lifetime of a specific asset.

- Total Cost of Ownership of IT infrastructure - Investing in IT infrastructure is complex, and sometimes pieces can be left out of the picture. Building a CMDB can be the best first step to understanding what it includes, and it can provide you with the visibility to properly calculate your entire IT estate's TCO.

The bottom line

Calculating the TCO of any asset is essential to ensure you get the best value for your money and have full visibility of the actual amount of money you are spending on your IT estate. To do the math, remember to use the TCO=I+M+R formula.

And one more thing: don’t forget that, in order to make decisions based on this metric, it’s essential to feed its components with accurate and updated information. That’s something you won’t achieve with just an Excel or a spreadsheet. But you can do it with InvGate Asset Management.

Insight will provide you with all the necessary information in real-time, so your TCO is never outdated. And that comes with a CMDB, an IT asset inventory, automation, and several other perks you can explore on our 30-day free trial. Do it now and start gaining full visibility of your costs!

Frequently Asked Questions

How to reduce the Total Cost of Ownership?

The best way to reduce the TCO is by leveraging IT Asset Management software since it’ll give you complete visibility over all your assets and associated costs. Additionally, with a specific tool, you can automate processes like contract expiration notifications, and asset depreciation to keep your data up-to-date and accurate.

What's the difference between Lifecycle Cost and TCO?

The TCO is an all-encompassing metric that considers the cost of ownership for any asset over its entire lifespan. This includes acquisition, maintenance, replacement costs, and additional service-related fees. On the other hand, Lifecycle Cost is a narrower concept that only considers direct costs associated with asset acquisition, maintenance, and replacement. It does not take into account any additional service-related costs.

Why is the Total Cost of Ownership important?

The TCO is an important concept when investing in any asset or service because, by understanding the total costs associated with ownership, you can make more informed decisions about budgeting and long-term spending.

Can the TCO be a measurement of success?

The TCO is a tool used to measure how much it costs you to own your assets and calculate the return on investment over time. While it's not usually a measure of success, it can give you an idea of a specific investment's success.

How do you measure the TCO?

The TCO can be measured using a variety of methods. We recommend using the formula TCO = Initial cost (I) + Maintenance cost (M) + Remaining cost (R).

When should TCO be performed?

The TCO should be performed whenever a new asset is acquired, or an existing one is updated. Additionally, it should be periodically recalculated to ensure accuracy and reflect any changes in usage patterns or costs associated with the asset.