Knowing how to compute equipment depreciation accurately is essential for any organization, especially those managing large hardware inventories. The reason is simple: IT equipment is expensive, and inaccurate tracking can affect budgets, audits, compliance, and planning.

Instead of relying on manual processes, the most effective way to calculate depreciation is by using dedicated software. This approach lets you automate calculations, standardize depreciation rules across assets, and set up alerts so you always know what to expect and when to act.

In this article, we’ll break down how InvGate Asset Management can automate the process to improve accuracy and save time. We’ll also walk you through a step-by-step approach to setting up depreciation rules, tracking values over time, and using the results to support smarter IT budgeting decisions.

What is asset depreciation?

Asset depreciation is the gradual reduction in the value of a physical asset over its useful life. It affects everything from computers and servers to printers and network equipment, making it an essential part of Hardware Asset Management.

As these items are used over time, their value diminishes. In accounting terms, depreciation allows businesses to spread the cost of an asset over its useful life, matching the expense with the revenue the asset generates.

Equipment depreciation methods

There are many depreciation methods. Each method has its own applications and benefits, and choosing the right one depends on the type of asset and the company’s financial goals. In the next paragraphs we’ll explain the following three:

- Straight line depreciation method.

- Declining balance method.

- Units of production method.

#1: Straight-line depreciation

This is the most straightforward and widely used method. It assumes that an asset will lose its value evenly over its useful life.

Example: A company purchases a server for $10,000. They expect to use it for 5 years and estimate that it will be worth $1,000 at the end. Each year, the server loses $1,800 in value. After 5 years, the server will be fully depreciated.

#2: Declining balance method

This method accelerates depreciation, meaning that an asset loses more value in the earlier years of its life. It reflects the idea that many assets lose value more quickly when they are new.

Example: An organization buys a set of laptops for $15,000 with a depreciation rate of 40%. In the first year, the laptops lose $6,000 in value. In the second year, they lose $3,600. This pattern continues, with the laptops losing more value in the earlier years compared to later years.

#3: Units of production method

This method ties depreciation to the asset's actual usage or production levels rather than just time. It’s particularly useful for assets whose wear and tear is more closely related to how much they are used.

Example: A company acquires a network printer for $5,000 and expects it to print 100,000 pages over its lifetime. If the printer produces 20,000 pages in the first year, it loses $1,000 in value that year. If it prints 30,000 pages in the second year, it loses $1,500 in value based on its usage.

How to pick the best method for IT asset depreciation

There’s no universal “best” depreciation method, it depends on how your organization tracks costs, plans refresh cycles, and reports asset value. That said, you can usually make the right choice by considering three practical factors: how the asset loses value, how predictable its usage is, and what your financial reporting goals are.

To simplify the decision, here’s a quick guide:

- Use straight-line depreciation when you want a simple, consistent, and easy-to-audit method. It works well for most IT assets because it spreads cost evenly across the expected lifecycle and keeps budgeting predictable.

- Use declining balance depreciation when assets lose value faster at the beginning of their lifecycle (which is common with laptops, smartphones, or high-turnover hardware). This method is useful if you want to recognize most of the cost earlier, which can better reflect real market value during the first years.

- Use units of production depreciation when equipment wear is strongly tied to usage instead of time. This method makes the most sense for assets like printers, manufacturing hardware, or devices that have measurable output (pages printed, hours of usage, cycles, etc.).

Tip: Many organizations standardize the straight-line method across most assets for simplicity, and only use alternative methods for specific asset categories where the lifecycle pattern is clearly different.

What is the depreciation rate for IT equipment?

Once again, there isn’t a single universal depreciation rate for IT equipment. Even when organizations use the same depreciation method, rates still vary because they depend on a few key inputs that are not always standardized across industries.

In practice, the depreciation rate depends mainly on:

- The useful life assigned to each asset type - This is the most important factor. One company may depreciate laptops over 3 years, while another may assign 4 or even 5 years depending on internal policy, refresh strategy, and budget planning.

- The depreciation method used - Straight-line depreciation spreads cost evenly across the useful life, while accelerated methods (like declining balance) recognize more depreciation in the early years. That’s why the same laptop can have a different yearly depreciation expense depending on the method.

- Occasional tax rules (especially in the US) - Tax depreciation methods, such as MACRS, may follow specific schedules that differ from internal accounting depreciation. Many organizations track both: one for financial reporting and another for tax purposes.

How to calculate straight-line depreciation rate

If you’re using straight-line depreciation, the depreciation rate is simple:

Straight-line depreciation rate = 1 / useful life

So, if an asset has a useful life of 4 years, the depreciation rate is:

1 / 4 = 0.25 (25% per year)

Straight-line depreciation example

Let’s say a company purchases a laptop for $2,000, expects to use it for 4 years, and estimates a salvage value of $200 at the end of its lifecycle.

- Depreciable amount = Cost − Salvage value

$2,000 − $200 = $1,800 - Annual depreciation expense = Depreciable amount / Useful life

$1,800 / 4 = $450 per year - Straight-line depreciation rate = 1 / Useful life

1 / 4 = 25% per year

So, under straight-line depreciation, the laptop loses $450 in accounting value every year, and depreciates at a consistent yearly rate of 25%.

Common useful life ranges for IT equipment

Below are useful life benchmarks commonly used by IT teams and finance departments for straight-line depreciation. These may vary by organization, but they provide a practical baseline.

| Asset type | Typical useful life |

Straight-line rate (approx.) |

| Laptops | 3 to 4 years | 33% to 25% |

| Desktops | 4 to 5 years | 25% to 20% |

| Workstations | 4 to 5 years | 25% to 20% |

| Servers | 4 to 6 years | 25% to 16.7% |

| Network switches and routers |

5 to 7 years | 20% to 14.3% |

| Firewalls and security appliances | 5 to 7 years | 20% to 14.3% |

| Wireless access points | 4 to 6 years | 25% to 16.7% |

| Storage devices (NAS/SAN) | 5 to 7 years | 20% to 14.3% |

| Printers | 4 to 6 years | 25% to 16.7% |

| Monitors and peripherals |

4 to 6 years | 25% to 16.7% |

| UPS devices | 5 to 7 years | 20% to 14.3% |

How to compute depreciation of equipment automatically with InvGate Asset Management

Now that we’ve seen how this practice can thoroughly improve your ITAM efforts, it’s time to learn how to automate it.

For this, InvGate Asset Management offers an efficient way to compute depreciation automatically by calculating it in real time based on customizable rules. Then, you can set up alerts to notify you when an asset's value hits a specific threshold so you can take action.

Let’s see how it’s done.

#1. Create a new depreciation rule

To start, log in to InvGate Asset Management using an Administrator account. This ensures you have access to the system’s full features and configuration settings.

For this example, we’ll create a general depreciation rule for computers. Keep in mind that you can repeat this process to create as many rules as needed for different asset types (laptops, servers, printers, network devices, and so on).

Once you’re in the platform, follow these steps:

- Go to Settings > Assets > Depreciation.

- Click "Add" to create a new depreciation rule.

- Then, configure the rule using the following settings (example configuration for computers):

- Name: Enter a clear rule name, such as "Computers – 5-year straight-line depreciation."

- Asset type: Select "Computers."

- Manufacturer: Leave this field blank so the rule applies to all computer manufacturers.

- Depreciation method: Select "Straight-line depreciation" (default option).

- Depreciation period: Choose "From acquisition year." This means depreciation will start in the same year the asset was acquired, which is a common and simple approach for IT hardware.

- Asset’s useful life: Set it to 5 years.

- Overwrite current information: Enable "Yes". This ensures the platform applies the new rule and recalculates values for assets that are already in your inventory.

- Once all fields are set, click Save to create the depreciation rule.

Note: In order to calculate its current price, the asset must have set the acquisition price, acquisition date, and residual value.

Once configured, InvGate automatically applies the rules, updating depreciation values in real time. You can also reorder rules to ensure they’re applied in the right sequence, making the process even more adaptable.

Keep in mind that if you are adding new assets or bulk editing existing ones, the depreciation calculation will be performed during the next scheduled task (which runs every hour). This way, the system always calculates up-to-date depreciation values.

#2. Automating alerts for asset depreciation

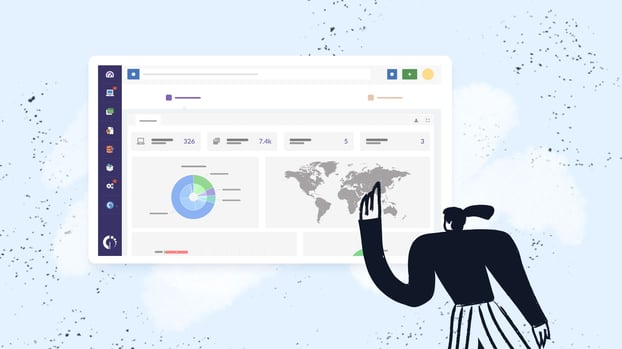

Finally, InvGate Asset Management allows you to automatically send alerts when specific conditions are met. This is key to act upon depreciation timely.

For instance, you can configure an alert to notify you when an asset’s value drops below a certain threshold — say, 50% of its original purchase price. This way you can ensure that you’re aware of assets that may need to be replaced soon.

Let’s see how to set up an email alert for this scenario:

- Go to Settings > Assets > Automations.

- Click “Add” to add a new automation and select “Custom automation.”

- Name the automation and provide a brief description to clarify its purpose. For example, you might call it "Depreciation Alert – Asset Value Below 50%".

- Select the event trigger "Asset current value updated." This ensures that the rule will activate whenever the depreciation calculation updates an asset's current value.

- Configure the following action rule:

- Asset > Current value > equal to or less than > 50% of the Acquisition cost.

- Click “Add action” and choose the “Send email” action to have the system send a notification whenever this condition is met.

This email can be sent to the finance team or asset managers so they’re aware that specific assets are approaching their end-of-life or may soon need to be replaced.

Additionally, you can personalize these notifications using dynamic placeholders (asset variables), so the message automatically includes key details such as the asset type, manufacturer, model, current value, acquisition cost, location, and a direct link to the asset profile (as shown in the image). This makes alerts clearer and reduces the need for manual follow-ups.

These automation tools add a layer of efficiency to the system, allowing IT departments and finance teams to stay informed about assets' depreciation status in real-time.