Are you keeping track of how your assets loose value over time? If not, you are missing out on crucial insights that can significantly impact your business's financial health, specially when it comes to fixed asset depreciation.

Although depreciation can seem like a straightforward accounting process, it's essential for maintaining accurate financial records, planning for future investments, and making informed business decisions.

In this article, we'll break down what fixed assets are, the benefits of calculating depreciation, and how you can automate the process to save time and reduce errors.

Let’s get started.

What are fixed assets?

Fixed assets are long-term tangible items that a company uses to generate income. Unlike inventory or consumables, these assets are intended for long-term use and often include machinery, equipment, vehicles, and even buildings. In IT and business operations, fixed assets may include servers, computers, and some types of software licenses.

These assets hold value and contribute to daily operations, but they don’t last forever. Over time, wear and tear, technological advancements, or obsolescence will cause them to lose their value.

This is where depreciation comes into the equation. Depreciation helps businesses track the reduction in an asset’s value, ensuring accurate financial reporting and better decision-making when it comes to replacements or upgrades.

Types of fixed assets

Fixed assets can vary widely across industries, but some common examples include:

- Office Equipment: Computers, printers, desks, and chairs

- IT Infrastructure: Servers, networking equipment, software

- Machinery and Tools: Production equipment, industrial tools

- Vehicles: Company cars, delivery trucks

- Buildings and real estate: Factories, warehouses, office buildings

Each of these asset types depreciates differently based on factors like usage, life expectancy, and residual value.

Are all IT assets fixed assets?

Not all IT assets are considered fixed assets. Fixed assets are typically long-term tangible properties used in a business's operations for over one accounting year.

While many IT assets like servers and computers qualify as fixed assets due to their long-term use and significant cost, other IT-related items may not meet this criterion.

For example:

- Software: Software can be classified as an intangible fixed asset if it is intended for long-term use. However, software licenses that are short-term or subscription-based are considered current assets.

- Peripheral devices: Items like keyboards or headsets are categorized as current assets, particularly if they are inexpensive and replaced frequently.

What is depreciation?

Depreciation refers to the gradual reduction in the value of a fixed asset over time. This decline happens due to various factors like wear and tear, usage, or technological obsolescence. Businesses use depreciation to account for the aging of their assets and to reflect the actual current value of these items in their financial records.

In practical terms, if you purchase a piece of machinery or IT equipment for your business, it doesn't hold the same value after a few years of use. Depreciation helps track how much of the asset's value has been "used up" over time, making it easier to determine when it needs to be replaced or upgraded.

Assets like vehicles, computers, and office equipment, for example, have a limited lifespan. Depreciation accounts for the portion of their value that diminishes annually, providing businesses with an accurate picture of their overall asset worth.

Why calculate depreciation?

Depreciation serves more than just an accounting function. Calculating the depreciation of fixed assets can provide several benefits, from better financial planning to ensuring compliance with tax laws. Here's how businesses can benefit from understanding and applying depreciation.

1. Accurate financial reporting

Depreciating fixed assets allows businesses to reflect the true value of their assets on financial statements. This is critical for both internal analysis and external reporting, as overvaluing assets can give a false impression of a company’s financial health. By calculating depreciation, businesses can maintain a single source of truth in accounting, ensuring that asset values remain consistent across financial reports, tax filings, and internal records.

For instance, if you’re reporting on IT assets like servers, it’s important to account for their declining value due to wear, tear, and eventual obsolescence. Depreciation ensures that these decreases are reflected over time rather than taking a single financial hit when the asset is retired.

2. Better investment decisions

Knowing the depreciation rate of fixed assets helps businesses plan future investments. If a company's IT infrastructure is depreciating faster than expected, it might be a sign to upgrade equipment or invest in new technologies. Understanding the lifecycle of your fixed assets allows you to time purchases, upgrades, or replacements more strategically.

For example, if your company’s servers are approaching the end of their depreciable life, you might review your IT budget to allocate money for replacements or upgrades, avoiding operational downtime.

3. Tax deductions

One significant benefit of depreciation is the potential for tax savings. In many jurisdictions, businesses can deduct the depreciation of their fixed assets from their taxable income. Calculating depreciation allows businesses to benefit from these deductions, lowering overall tax liability.

Different tax authorities provide various depreciation methods, such as straight-line or declining balance, that may impact how much you can deduct each year. Understanding these methods is vital to maximizing tax benefits.

4. Budgeting for asset maintenance and replacement

Depreciation is not just about tracking loss of value but also about preparing for future costs. Businesses can allocate funds for asset maintenance, repairs, or replacements by calculating depreciation.

It provides a clearer picture of when assets are likely to need an upgrade or replacement, helping businesses avoid unexpected expenses and budget more effectively.

Knowing the exact point at which an asset will lose its value also helps avoid downtime, ensuring smooth business operations, especially when it comes to critical IT assets like servers or communication systems.

Methods to calculate fixed asset depreciation

There are several methods of calculating depreciation. The most common include:

Straight-line method:

- The most straightforward method

- Annual depreciation = (Cost of asset - Salvage value) / Useful life

- Results in equal depreciation expense each year

Declining balance method:

- Accelerated depreciation method

- Applies a higher depreciation rate in the early years of an asset's life

- Annual depreciation = Book value at beginning of year × Depreciation rate

- Depreciation rate is typically double the straight-line rate

Sum-of-the-years' digits (SYD) method:

- Another accelerated method

- Calculates depreciation based on the sum of the years of the asset's useful life

- Results in higher depreciation in earlier years

Units of production method:

- Based on the asset's usage or productivity rather than time

- Useful for assets where usage varies significantly from period to period

Impact of depreciation on financial statements

Depreciation affects several key financial statements:

- Balance sheet: It reduces the book value of assets. Accumulated depreciation is recorded as a contra-asset account

- Income statement: Depreciation expense reduces net income and impacts profitability ratios.

- Cash flow statement: While depreciation reduces net income, it's added back in the operating section of the cash flow statement as it's a non-cash expense

- Tax returns: Depreciation is typically tax-deductible, reducing taxable income

How to calculate depreciation of fixed assets automatically

While calculating depreciation manually is possible, automating the process brings several advantages, especially for businesses with a large number of assets.

ITAM solutions can help businesses streamline the process with automated calculations for tracking depreciation, ensuring accuracy and saving time.

1. Centralized Asset Tracking

Asset Management software provides a centralized platform to track all fixed assets, their purchase dates, life expectancy, and current value.

This eliminates the need for multiple spreadsheets or manual entry, reducing the chance of human error. With automated systems, you can set depreciation schedules based on asset types, ensuring the system calculates depreciation consistently over time.

For instance, an IT department managing hundreds of computers can use Asset Management software to track depreciation rates for each machine, automatically adjusting their value as time progresses.

InvGate Asset Management allows organizations to automatically discover and manage their inventory of physical, virtual, and cloud assets. With a centralized platform, organizations can eliminate the need for multiple spreadsheets, reducing human error and enhancing data accuracy.

2. Automated calculations

Many Asset Management systems come with built-in compliance features that ensure depreciation is calculated according to the latest accounting standards and tax laws. This is particularly useful for companies that need to follow strict regulatory requirements.

For instance, some systems can automatically apply the correct depreciation method (e.g., straight-line or reducing balance) based on the type of asset and jurisdiction, helping businesses stay compliant with local regulations while optimizing tax savings.

InvGate Asset Management includes an automatic depreciation functionality that allows businesses to track depreciation for their assets.

3. Reporting and analytics

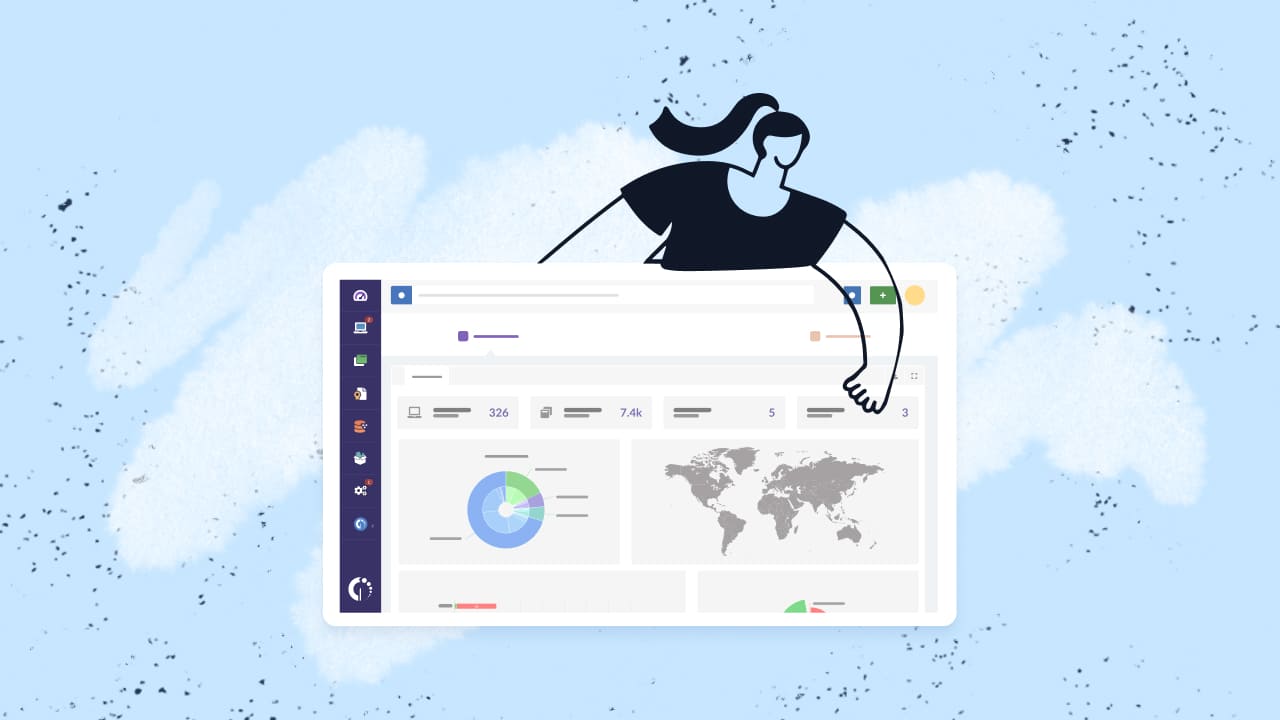

Automation also enables real-time reporting, giving businesses an up-to-date view of their fixed assets’ depreciation. This can help business leaders make informed decisions about asset replacement and maintenance in a timely manner.

Moreover, it allows for more detailed analytics, such as comparing asset performance across different departments or locations.

InvGate's robust reporting and analytics capabilities provide real-time insights into asset performance and depreciation. This feature enables business leaders to make informed decisions regarding asset replacement and maintenance. Companies can analyze data across different departments or locations to identify trends in asset depreciation.

Conclusion

Understanding and managing the depreciation of fixed assets is crucial for businesses of any size. Depreciation provides a clearer picture of an asset’s true value over time, helping with everything from financial reporting to tax savings.

Automating this process with IT Asset Management software ensures accuracy, saves time, and reduces the risk of errors. With automated systems, businesses can focus more on strategic decisions, like when to upgrade or replace assets, rather than getting bogged down in manual calculations.

Effective management of fixed assets isn’t just about keeping track of what you have; it’s about ensuring you’re prepared for the future. And as your business grows, so will your need to manage assets efficiently and strategically.

Are you ready to start? You can try InvGate Asset Management to calculate fixed asset depreciation automatically. Sign up for your 30-day free trial!

Frequently Asked Questions

Why is depreciation important for businesses?

Depreciation helps businesses match the cost of an asset with the revenue it generates, ensuring accurate financial reporting. It also provides tax benefits by reducing taxable income, thus helping in effective cash flow management.

What are the common methods of calculating depreciation?

The most common methods include:

- Straight-Line Method: Allocates an equal expense each year.

- Declining Balance Method: Accelerates depreciation, applying a fixed percentage to the remaining book value.

- Sum-of-the-Years' Digits: Accelerates depreciation by applying a fraction based on the asset's remaining life.

- Units of Production Method: Bases depreciation on actual usage rather than time.

What is the depreciable base?

The depreciable base is calculated by subtracting the salvage value (the estimated residual value at the end of its useful life) from the asset's initial cost. This amount is then used to calculate annual depreciation.

When does depreciation start for an asset?

Depreciation begins when the asset is placed into service and is ready for use, not when it is purchased. This means that depreciation starts once the asset is functional for its intended purpose.

How should I record depreciation in financial statements?

Depreciation should be recorded as an expense on the income statement and as a reduction in the asset's book value on the balance sheet. The journal entry typically involves debiting Depreciation Expense and crediting Accumulated Depreciation.

Can I change my depreciation method?

Yes, businesses can change their depreciation method if justified by changes in circumstances or accounting policies. However, it's essential to disclose this change in financial statements and ensure compliance with accounting standards.