IT Risk Management Software supports how organizations identify, track, and address risks that arise from their IT systems and services. Within ITIL-aligned practices, these tools help teams connect technology risk to areas such as change enablement, service continuity, information security, and supplier management, keeping risk work close to everyday IT operations.

For organizations facing tighter compliance requirements, evolving cyber threats, or complex third-party networks, the right software helps surface IT risk earlier and act on it with more clarity. The focus stays on concrete, operational issues: unsupported systems, weak access controls, failed changes, missing backups, shadow IT, vendor dependencies, or gaps in incident response. Addressing those risks requires tooling built for IT environments, processes, and controls.

Below are eight software options that can help organizations manage risk in their IT environments.

What IT Risk Management software

IT Risk Management software supports the identification, tracking, and treatment of risks that originate in IT systems and IT operations only. Its scope is limited to technology-related exposure, not enterprise-wide business risk.

The software helps IT teams document risks tied to infrastructure, applications, access, changes, and service dependencies. Each risk is owned, reviewed on a defined cadence, and linked to concrete mitigation actions. Over time, teams can see how their IT risk profile changes as systems are upgraded, controls are added, or incidents occur.

Day-to-day use looks operational rather than strategic. Risks are reviewed as part of regular IT work, not just during audits. Workflows handle ownership, approvals, and follow-ups. Automation supports recurring reviews and evidence collection. Reporting focuses on current exposure and open actions instead of theoretical risk statements.

Core capabilities of IT Risk Management software

Most IT-focused Risk Management tools include:

- Structured risk records tied to systems, services, and IT assets.

- Automated review cycles, reminders, and approvals.

- Dashboards and reports designed for IT leadership and governance forums.

- Support for compliance and audits through controls, evidence, and traceability.

What's the difference between IT Risk Management software and broader Risk Management platforms?

When teams talk about Risk Management in general, they often mean everything that could affect the business: financial exposure, legal issues, safety, reputation, suppliers, and more. IT Risk Management is much narrower. It focuses only on risks that come from technology and how IT is run.

Broader Risk Management platforms cover many risk domains at once: financial, legal, operational, strategic, safety, and IT. Their models and language are designed for enterprise risk teams and executive reporting.

IT Risk Management software reflects how IT teams actually work, using system-level context instead of abstract risk categories.

Best IT Risk Management software solutions for 2026

Methodology

A brief disclosure before diving in: InvGate develops IT Service Management and IT Asset Management software, so we participate directly in this market.

Some tools mentioned here compete with our own. That said, the goal of this article is to offer clear, fair, and useful guidance to support your buying process.

Our analysis relies on publicly available information, including vendor materials, official documentation, user feedback from sources such as Gartner Peer Insights, G2, and Capterra, analyst research, and product demos or hands-on evaluations when possible. Each platform is reviewed across several dimensions, including core capabilities, pricing transparency, integration options, usability, and the quality of vendor support.

All details reflect the state of the market as of November 2025. We revisit and update this content on a regular basis to account for product changes and market shifts.

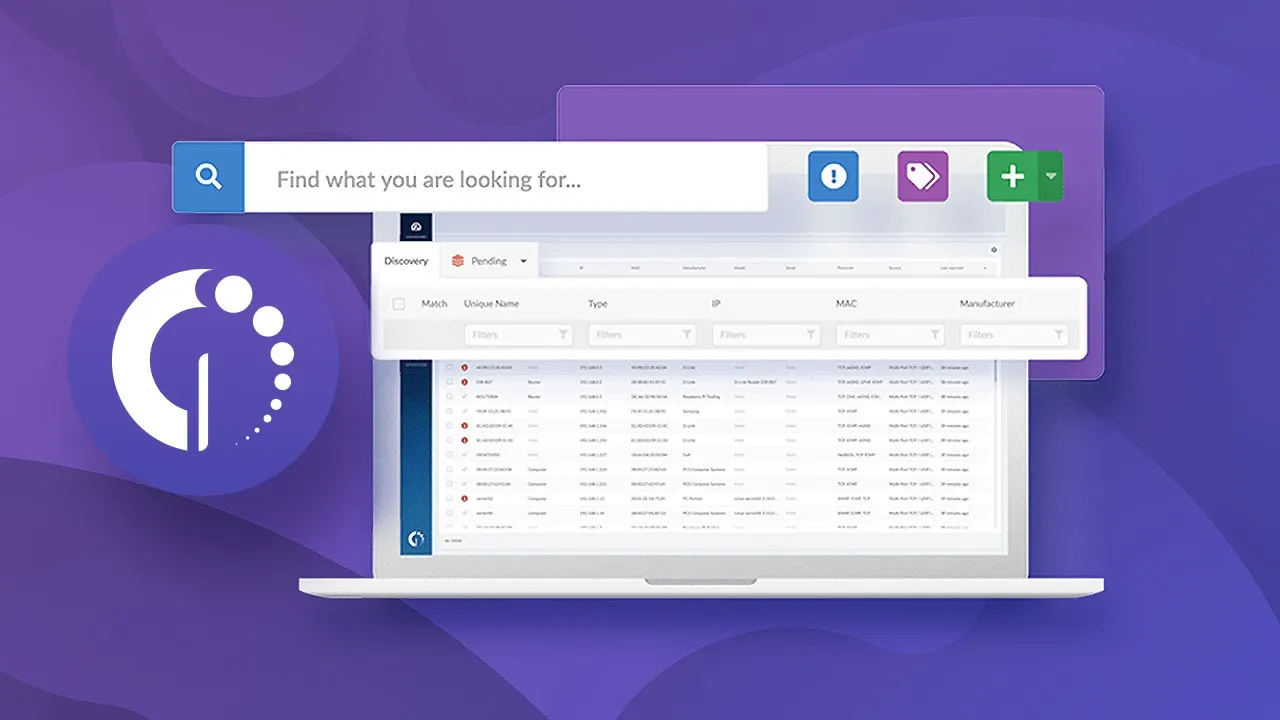

InvGate Asset Management

InvGate Asset Management is an ITAM solution that can help address risk at the infrastructure level. It isn't a dedicated IT Risk Management platform; however, it can support risk-related workflows by centralizing data, automating responses, and improving visibility across your IT assets. Depending on the complexity of your risk program, that might be enough — or a practical foundation before adopting something more specialized.

InvGate Asset Management features

- Inventory Management: Build a complete IT asset inventory in under 24 hours. With multiple discovery methods, you’ll always know what you have and where it’s located.

- Risk Management automation: Set custom asset Health Rules to detect and respond to issues before they escalate. Automated alerts enable faster reactions and more proactive risk mitigation.

- Risk and impact analysis with AI: Predictive tools assess the risk and impact of change requests based on historical patterns. This helps teams avoid underestimating issues and supports business continuity.

- CMDB (Configuration Management Database): Map relationships between assets, services, and users. This visibility supports better decision-making and helps assess operational risks.

- Advanced reporting: Analyze trends, identify vulnerabilities, and prepare for audits using customizable dashboards and reporting tools.

- Integrations: Connect with identity management tools, directories, and InvGate Service Management to align risk and IT operations.

InvGate Asset Management pricing details

InvGate Asset Management offers scalable pricing based on the number of nodes you need to manage.

The plans are:

- Starter Plan: Covers up to 500 nodes at $0.21 per node per month ($1,250 billed annually).

- Pro Plan: Supports 501-10,000 nodes at $0.38 per node per month (billed annually).

- Enterprise Plan: Tailored for large enterprises with custom node requirements. Contact sales for pricing.

Unsure which plan suits you? Start with a 30-day free trial (no credit card required)

InvGate Asset Management user reviews and ratings

InvGate Asset Management holds a 4.5/5 score on Gartner Peer Insights. Users appreciate its ease of use and powerful automation, especially in environments with many endpoints. Reviews highlight the tool’s flexibility for custom workflows.

“My Overall experience with InvGate Asset Management is Awesome. It's maintenance scheduling feature has reduced downtime, we can easily schedule in advance. It's user interface is good intuitive and easy to use, It's implementation process is smooth. I can easily share the data between the systems; It has seamless integration with our ERP system.”

User review from Gartner, Manager - Facilities

RSA Archer

Developed by RSA, Archer® is an integrated Risk Management platform often used by enterprises for governance, risk, and compliance (GRC) initiatives. It helps organizations centralize data, automate processes, and gain insight into risks across departments.

Archer features

According to their official website (accessed December 2025), the platform offers these functionalities.

- Risk register: Maintain a centralized view of known risks, including ownership, impact, and mitigation plans.

- Third-party Risk Management: Assess and monitor vendor risks through built-in questionnaires and workflows.

- Audit Management: Track audit findings and link them to associated risks and controls.

- Policy Management: Distribute policies, track acknowledgments, and ensure version control.

Archer pricing details

Pricing is not publicly available. It typically varies depending on the number of modules, users, and deployment scale.

Archer user reviews and ratings

- Gartner Peer Insights score: 4.2

- G2 score: 3.6

MetricStream Cyber GRC

MetricStream® GRC is a suite of governance, risk, and compliance (GRC) products developed by MetricStream, a long-standing provider of enterprise risk and compliance solutions.

It includes enterprise risk, compliance, audit, policy, and vendor risk modules, allowing IT risk work to connect with wider organizational risk processes. It’s designed to help teams centralize IT and cyber risks, quantify exposure, track vulnerabilities and controls, and support remediation in a structured environment. The solution offers advanced analytics and reporting so IT leaders can see risk exposure in context and communicate it effectively to stakeholders.

MetricStream features

These are some of the features listed on their website:

- Central repository for IT risks, assets, threats, and vulnerabilities.

- Risk quantification. Uses models to put a monetary value on cyber risk, aiding prioritization and executive communication.

- Threat and vulnerability consolidation. Imports and correlates vulnerability data from scanners and threat feeds.

- Configurable views show risk exposure, trends, and control effectiveness for IT and security audiences.

- Connects to CMDBs, ITSM, SIEMs, and other tools to enrich asset and risk data and support workflows.

MetricStream pricing details

Pricing is quote-based and tailored to your use case, number of users, and modules required.

MetricStream user reviews and ratings

- Gartner Peer Insights score: 4.3

- G2 score: 3.9

Splunk Asset and Risk Intelligence

Splunk® Asset and Risk Intelligence is a security-oriented IT risk tool from Splunk that builds a detailed, continuously updated view of assets and identities across an organization’s IT environment.

It correlates data from network, endpoint, cloud, and scanning tools to give teams accurate context about devices, users, and applications — including relationships and activity — so risk exposure is clearer. The platform is often used alongside Splunk Enterprise Security to accelerate incident investigations, reduce blind spots in asset inventories, and help assess compliance gaps in security controls.

Splunk delivers this mostly as a cloud or on-premise extension of its core SIEM and security ecosystem, with integrations into CMDBs like ServiceNow and other security data sources.

Splunk features

These are some of the tool's features, as listed on their website.

- Continuous asset discovery and inventory.

- Investigation dashboard with context.

- Risk scoring and compliance metrics.

- Integrations with Splunk Enterprise Security and CMDBs.

- Custom compliance metrics.

Splunk pricing details

Splunk uses a usage-based pricing model, which depends on data ingestion volume. Pricing details are available on request.

Splunk user reviews and ratings

There are no reviews on the Asset and Risk Intelligence tool in particular. For reference, these are the scores in review sites for their wider Enterprise Security platform:

- Gartner Peer Insights score: 4.5

- G2 score: 4.3

ZenGRC

ZenGRC® provides Risk and Compliance Management with an emphasis on visibility and audit readiness. It’s known for its simple interface and structured approach to tracking risks, controls, and remediation tasks across IT and security domains. The platform is cloud-based and integrates with directory services, vulnerability scanners, and ticketing systems to surface risk information without manual overhead.

ZenGRC features

The official product page includes these features, among others:

- Centralized risk register, with timeline and heatmap.

- Risk reporting.

- Evidence tracking.

- Integration with security and IT service tools.

- Vendor Management, with vendor questionnaires.

ZenGRC pricing details

ZenGRC pricing isn't public or standardized; it's custom.

ZenGRC user reviews and ratings

- Gartner Peer Insights score: 4.2

- G2 score: 4.4

LogicManager

LogicManager® offers risk, compliance, and control tracking with a modular design that fits IT risk programs as well as broader governance needs. Known for customizable workflows and strong reporting, the platform helps teams document IT risk registers, define controls, and route remediation work across IT and security teams. Cloud deployment is standard, and API integrations support data exchange with identity and monitoring tools. Zluri

LogicManager features

The company’s product page (accessed December 2025) highlights these as part of the platform’s offering.

- Workflow automation and escalation.

- Risk escalation and event response.

- Customizable dashboards.

- Control libraries aligned to standards.

- Pre-built risk libraries that you can customize and expand.

LogicManager pricing details

According to their web (checked on December 2026), LogicManager uses a fixed-fee, value-based model, not per-user pricing, based on your "jobs-to-be-done," including unlimited users, full support, and onboarding. It requires a custom quote for the exact cost.

LogicManager user reviews and ratings

- Gartner Peer Insights score: 4.6

- G2 score: 4.3

OneTrust

OneTrust® focuses on tech-centric risk and compliance, with strong support for privacy, security, and IT risk needs. Developed by OneTrust, it bridges IT risk with data governance and compliance frameworks, helping teams standardize policies and track evidence across systems. The platform includes connectors for cloud services, identity platforms, and third-party risk data.

OneTrust features

These are among the tool’s main features, as stated on its official page (accessed December 2025).

- IT and Cyber Risk Management: Conduct assessments and manage remediation workflows.

- Third-party risk tools: Automate due diligence, onboarding, and monitoring of vendors.

- Privacy compliance: Built-in templates and tracking for GDPR, CCPA, and more.

- Policy and ethics programs: Manage codes of conduct, training, and disclosures.

OneTrust pricing details

Pricing is subscription-based and varies widely depending on use cases and the number of modules licensed.

OneTrust user reviews and ratings

- Gartner Peer Insights score: 4.1

- G2 score: 4.6

SAI360 IT Risk and Cybersecurity

SAI360® provides a suite covering risk, compliance, and cybersecurity process management. Its IT risk modules include vendor-related risk workflows, automated assessments, and compliance mapping. The tool is often selected by organizations needing support for regulatory standards and IT risk monitoring. Deployment is typically cloud-based, with integrations available for CMDBs and other IT data sources.

SAI360 IT Risk and Cybersecurity features

These are among the tool’s main features, as stated on its official page (accessed December 2025).

- Automated risk assessments and workflows.

- Compliance and control mapping for frameworks like NIST CSF, ISO/IEC 27001.

- Remediation Management.

- Dashboards and analytics.

- IT risk and control library with a regulatory content knowledge base with requirements pre-mapped to frameworks and controls.

SAI360 IT Risk and Cybersecurity pricing details

SAI360 IT Risk & Cybersecurity pricing isn't public; it's customized based on your organization's size, needs, and modules, requiring a direct quote from them.

SAI360 IT Risk and Cybersecurity user reviews and ratings

- Gartner Peer Insights score: 4.6

- G2 score: 4.1

Disclaimer: All product names, logos, and brands are the property of their respective owners. All company, product, and service names used on this site are for identification purposes only. Use of these names, trademarks, and brands does not imply endorsement. Comparisons are based on publicly available information as of December 2025 and are provided for informational purposes only.

How to choose IT Risk Management software (checklist)

Choosing IT Risk Management software works best when you treat it as a layered decision, not a feature comparison. Our suggestion is to start with the basics of visibility and control, then add complexity as your IT risk practice matures. Tools that work well in one environment may fall short in another if the underlying data, processes, or ownership are not in place.

Start by defining the scope you actually need to cover today, then look at what you want to add over time. The checklist below follows that logic, beginning with foundational requirements and moving toward more advanced capabilities.

1. Confirm you have a reliable IT inventory

IT risk cannot be managed without knowing what exists in your environment. Before evaluating risk tooling, verify that you can consistently identify systems, applications, services, and key dependencies.

If asset data is incomplete or outdated, risk signals will be inaccurate. In that case, starting with IT Asset Management or a CMDB that can support risk context may be necessary before introducing a dedicated IT Risk Management tool.

2. Check how risk data connects to IT systems

Once inventory is in place, look at how the software ingests and links technical data. Strong tools connect risks to real IT objects such as assets, services, users, or vendors instead of treating risks as standalone records.

Integration with ITSM platforms, CMDBs, vulnerability scanners, or cloud environments reduces manual input and keeps risk information aligned with operational changes.

3. Evaluate workflow support for IT teams

Risk tracking should fit into how IT already works. Review how the tool handles ownership, approvals, review cycles, and remediation tasks.

Clear workflows help avoid risks sitting idle in a register. Automation for reminders, escalations, and status updates becomes increasingly important as the number of tracked risks grows.

4. Review reporting depth and audience fit

Not all reporting serves the same purpose. Operational teams need views that highlight open actions, affected systems, and trends. IT leadership often needs summaries that show exposure, movement over time, and areas of concern.

Check whether dashboards can adapt to different audiences without heavy customization or external reporting tools.

5. Consider compliance and audit alignment

If audits or regulatory requirements apply, confirm that the software supports control mapping, evidence collection, and traceability within the IT domain.

Risk data should support audit conversations without requiring separate tools or manual reconciliation. Even if compliance is not the primary driver today, this capability often becomes relevant later.

6. Plan for growth and added complexity

Finally, think about what comes next. Some teams start with basic IT risk tracking and later add cyber risk, vendor risk, or tighter integration with enterprise risk practices.

Choosing software that can expand its scope without forcing a full replacement helps protect the investment and supports a more mature IT Risk Management practice over time.

How do you evaluate Risk Assessment software and integrated Risk Management software?

Evaluating risk tools starts with understanding how far your risk practice needs to extend beyond IT. Some teams only need structured assessments to support technical decisions. Others need to connect IT risk data with compliance, controls, and executive reporting. The difference between risk assessment software and Integrated Risk Management software becomes clear once the scope and audience are defined.

When it makes sense to move beyond IT

Staying within IT works when risks are owned and resolved entirely by technology teams. Once risk data needs to support compliance reporting, internal audit, or executive oversight, keeping it isolated becomes a limitation.

A move to an integrated platform usually makes sense when IT risk feeds into broader discussions around regulatory exposure, third-party oversight, or enterprise-level decision-making. At that point, risk information must align with controls, policies, and assurance activities outside IT.

What to look for in risk assessment software

Risk assessment modules focus on evaluating and documenting risk in a structured way. When reviewing these tools, look closely at how they support:

- Assessment types: Support for qualitative, quantitative, or scenario-based assessments, depending on how IT teams evaluate impact and likelihood.

- Scoring models: Flexible scoring that reflects IT realities, not fixed templates that are hard to adapt to systems or services.

- Approval workflows: Clear review and sign-off paths so assessments do not remain informal or undocumented.

- Reporting: Practical views that show risk levels, trends, and changes over time for IT leadership.

Integrated Risk Management Software expands visibility beyond a single domain. Instead of treating IT risk as a standalone activity, it connects risks to controls, compliance requirements, and assurance processes across the organization.

Key contributions include cross-functional visibility, shared control libraries, and consolidated reporting for senior leadership. Risk data becomes comparable across domains, which supports prioritization and oversight at the management and board level.